By: Chris Warren.

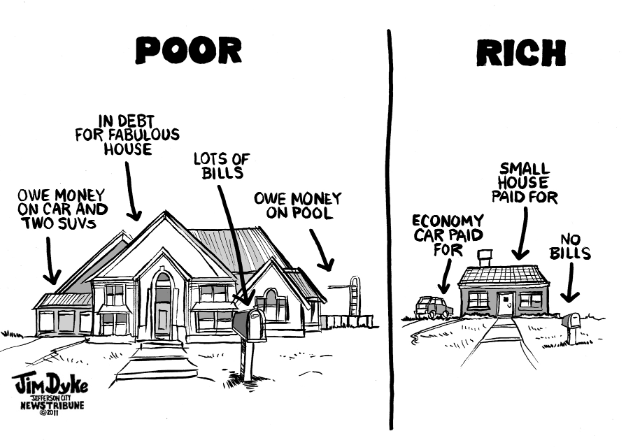

In a political year where income inequality is a major theme, not much attention is being paid to what I’m going to call “spending inequality”. We have little control over how much we earn in relation to everyone else, but we have quite a bit of control over what we buy. When one lives beyond their means, or carries debt for the purpose of appearing more affluent than they really are, they are practicing spending inequality.

For all the liberal screeching about how the middle class is being ripped off and sucked dry while the rich get fat at the expense of everyone else (a claim that is overplayed but not complete bullshit, by the way), there’s not even a whisper about one’s personal responsibility to handle carefully the money they do have. The rich may indeed be getting richer, but that’s not a license for us average folk to go into debt up to our eyeballs. How many people resent the rich while at the same time wanting to be like them? That unhealthy envy is what fosters spending inequality.

The other day I heard on a talk radio show that 47% of American adults could not raise $400 liquid cash on a day’s notice. That figure, which I accept as accurate if not generously low, is telling and disturbing.

We’re not talking about people who are broke due to exceptional circumstances: They got some horrible disease or their house burned down or their ex-spouse drained the bank account and skipped town. Forty-seven percent is not an outlier. It’s mainstream. How did we get to a place where it’s “normal” that nearly half of America cannot come up with a few hundred bucks for an unexpected emergency, yet they are constantly acquiring stuff?

There are millions of Americans who have practiced spending inequality to the point where they have elaborate home entertainment systems, upscale cars, go on luxurious vacations, and dress their kids in expensive trendy sportswear while every cent of the money used to pay for all that bling is money they have not earned yet. Sadly, having these things and going into heavily debt to get them is considered normal life.

What used to be quaintly referred to as “keeping up with the Joneses” has been elevated to unprecedented levels mostly because there is more stuff to buy and more ways to avoid paying cash for it.

Decades ago, there was no iPad, smartphone, laptop computer, and flat screen TV for everyone in the house. There were no spring break trips to Acapulco. There were no $170 pairs of kids’ Nike shoes. And there was no “instant credit.” Spending inequality was difficult because most stuff was paid for in cash. There was a built in ceiling on how much one could afford to show off.

Spending inequality starts in the young, as exemplified by the all the soon-to-be graduated high school seniors who, with the whole blessing of their parents, are at this very moment signing up for decades of heavy student loan payments in exchange for on campus excitement at a name brand four year university because living at home and attending the local community college for a year or two and saving tens of thousands of dollars isn’t cool enough for them. Well over half of them will not make it to commencement; they’ll still be on the hook for a ton of money without even having a degree to show for it.

I have to admit the concept of spending inequality is a bit foreign to me because I’ve never been inclined to buy a lot of stuff just because everyone else was. Furthermore, my circle of family and friends are financially sensible, so there is no peer pressure or sense of competition. None of us are living large, or pretending that we are.

As I get older I’m less and less impressed with other people’s showing off, nor do I care what others notice about me. I drive an average car, live in an average house, and buy my clothes at the outlet mall.

It’s important to point out that spending inequality is a problem that is completely within our individual power to control. Those of us who sleep well at night knowing a $400 unplanned expense won’t sink us don’t understand spending inequality, nor do we want to. There is no man more free than the one who does not care what others think.